How to Invest in Miami Real Estate Investment Tips & Insights

How to Invest in Miami

Learn how to invest in Miami real estate with smart strategies for selecting properties, understanding market dynamics, managing risk, and maximizing returns. A comprehensive guide for new and seasoned investors alike.

Introduction: Why Invest in Miami?

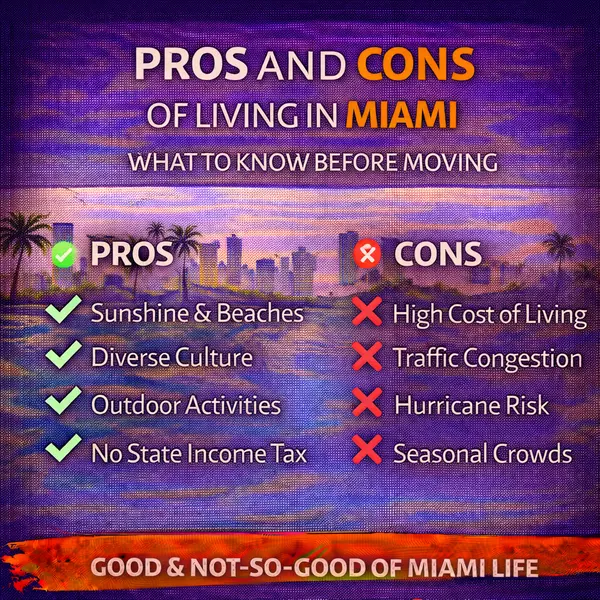

Miami’s real estate market is one of the most dynamic and attractive investment landscapes in the United States. With strong international demand, diverse property types, population growth, and solid rental markets, it’s no surprise investors consistently consider Miami for long‑term wealth building.

But how to invest in Miami wisely requires understanding local market conditions, investment goals, risk tolerance, and proven strategies tailored to this unique region.

In this guide, you’ll learn core principles of successful real estate investment in Miami — from choosing the right property type to understanding neighborhood trends and maximizing returns.

1. Define Your Investment Goal

Before buying your first property, identify your primary objective:

• Cash Flow

Generate positive monthly income through rent.

• Appreciation

Seek long‑term value growth and equity build‑up.

• Hybrid

Combining both income and appreciation to balance risk and return.

Defining your goal will shape your strategy and property choice.

2. Understand Miami’s Neighborhood Dynamics

Miami is not a single homogeneous market — each neighborhood has its own rhythm:

Urban & Downtown Areas

Areas like downtown and central urban locations attract renters and buyers seeking walkability, convenience, and lifestyle amenities.

Waterfront & Coastal Communities

Properties near the water often command premium values and experience strong demand from buyers and renters alike.

Suburban & Family‑Friendly Markets

Suburban neighborhoods can offer affordability and strong rental appeal for families and long‑term residents.

Knowing the strengths of different Miami sub‑markets is key to making smart investment decisions.

3. Choose Your Investment Property Type

Different property types serve different goals:

• Single‑Family Homes

Great for long‑term appreciation and family‑oriented rentals.

• Condominiums

Condos often offer strong rental demand and lifestyle appeal, especially in walkable or waterfront areas.

• Multi‑Family Properties

Duplexes and small apartment buildings can enhance cash flow potential and diversify rental income.

• New Construction

New builds may offer warranties, modern amenities, and strong appeal to renters or buyers.

Each type carries unique costs, maintenance requirements, and financing considerations, so choose based on your goals and resources.

4. Analyze Rental Markets and Demand

If your investment strategy includes renting, consider rental demand patterns:

• Vacancy Rates

Areas with lower vacancy indicate stronger demand.

• Rent Growth Trends

A rising rent trend strengthens income potential.

• Tenant Preferences

Amenities, location convenience, and lifestyle features influence what tenants value most.

Analyzing these fundamentals helps you identify properties with stable or rising rental income potential.

5. Crunch the Numbers Carefully

Investment success hinges on solid financial analysis:

• Cash Flow Analysis

Estimate rental income minus all expenses (taxes, insurance, maintenance, utilities).

• Return on Investment (ROI)

Calculate potential annual returns based on net income and purchase price.

• Appreciation Projections

Consider how property value may grow over time.

Always build conservative estimates into your forecast to cushion against unforeseen costs.

6. Understand Financing Options

Financing an investment property can vary depending on your approach:

• Conventional Loans

Common choice with competitive rates but stricter requirements.

• Portfolio Lenders

May offer flexibility for investments not fitting traditional criteria.

• Cash Purchases

Can simplify the buying process and improve cash flow by reducing debt costs.

Choose financing based on your capital, risk tolerance, and long‑term strategy.

7. Partner With Local Professionals

Miami real estate has nuances that local experts understand well. Consider working with:

-

Real estate agents who know neighborhood trends

-

Property managers who handle rentals and maintenance

-

Accountants or tax advisors for financial planning

Local expertise helps you make informed choices and avoid costly missteps.

8. Prepare for Risk and Market Cycles

No investment is without risk. Consider:

• Market Fluctuations

Property values and rents can vary with economic trends.

• Weather Risks

In hurricane‑prone areas like Miami, consider protection measures and insurance needs.

• Vacancy or Turnover

Plan for occasional vacancies and tenant turnover costs.

Prudent investors build reserves to protect against unexpected challenges.

9. Long‑Term Exit Strategy

A strong investment plan includes an exit strategy:

• Hold for Cash Flow

Keep the property to collect rent long‑term.

• Sell After Appreciation

Sell when market conditions maximize value.

• 1031 Exchange

Defer taxes by reinvesting into another investment property (consult your tax strategist).

Understanding the end goal gives purpose to your strategy at every stage.

Conclusion: Smart Investment Starts With Strategy

Investing in Miami real estate can be highly rewarding — but success requires thoughtful strategy, diligent analysis, and an understanding of local market dynamics. Define your goals, choose the right property type, analyze financials carefully, and build a team of trusted experts to support your journey.

Whether seeking rental income, long‑term appreciation, or a balance of both, Miami’s market offers multiple paths to investment success when approached with clarity and confidence.

Frequently Asked Questions (FAQs)

Is Miami a good place to invest in real estate?

Miami offers strong demand, diverse renters, and international appeal — making it a compelling investment location.

Should I invest in Miami condos or single‑family homes?

Both can be strong investments; condos often appeal to urban and lifestyle renters, while single‑family homes may suit long‑term family renters.

How do I calculate rental income potential?

Estimate rent you can charge based on comparable properties and subtract operating expenses to gauge net income.

What is the best neighborhood to invest in Miami?

That depends on your goal — high rental demand, appreciation potential, or lifestyle appeal — so analyze each neighborhood carefully.

Can I invest in Miami real estate with a small budget?

Yes — smaller condos, multi‑family properties with partners, or structured financing can help you enter the market.

Do investors need a property manager?

If you’re not local or don’t want hands‑on management, a property manager can streamline operations and tenant relations.

What risks should investors consider?

Weather risks, vacancy, maintenance costs, and market cycles are key considerations for long‑term investment planning.

Categories

Recent Posts

GET MORE INFORMATION